are union dues tax deductible in oregon

NE Suite 103 Keizer OR 97303. Whom does an employer contact for information regarding deductions for tax withholdings required by law.

New Business Travel Per Diem Rates Announced For 2020

Contact the Oregon Department of Revenue state withholdings 503 378.

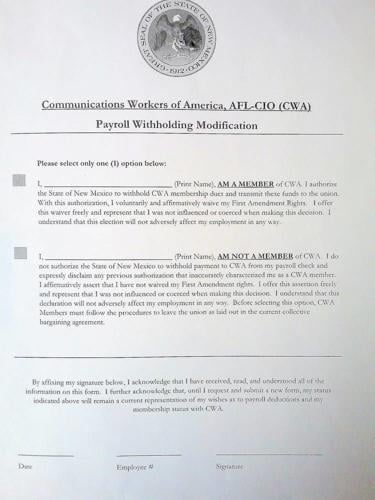

. To claim union dues as a deduction you must use the long Form 1040. The Supreme Courts ruling made clear that a government employer cannot deduct union dues or fees from employees paychecks unless the employee has clearly and affirmatively consented. Union dues are reported on Schedule A Form 1040 Itemized Deductions.

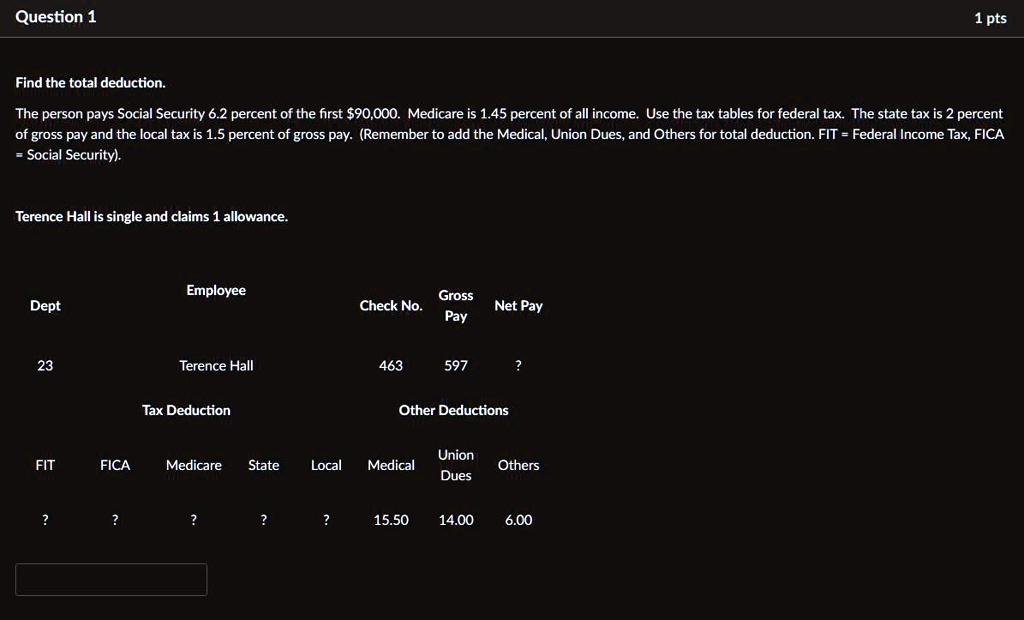

However most employees can no longer deduct union dues on their federal tax return in tax. Susan - Union dues does not fit into the adjustments to income section of the Form 1040 and cant be use in that way to reduce income. Oregon personal income tax.

Critics of the proposal say a union dues tax credit would essentially shift the burden of the dues from public employees to taxpayers. For tax years 2018 through 2025 union duesand all employee expensesare no longer deductible. If youre self-employed you can deduct union dues as a business expense.

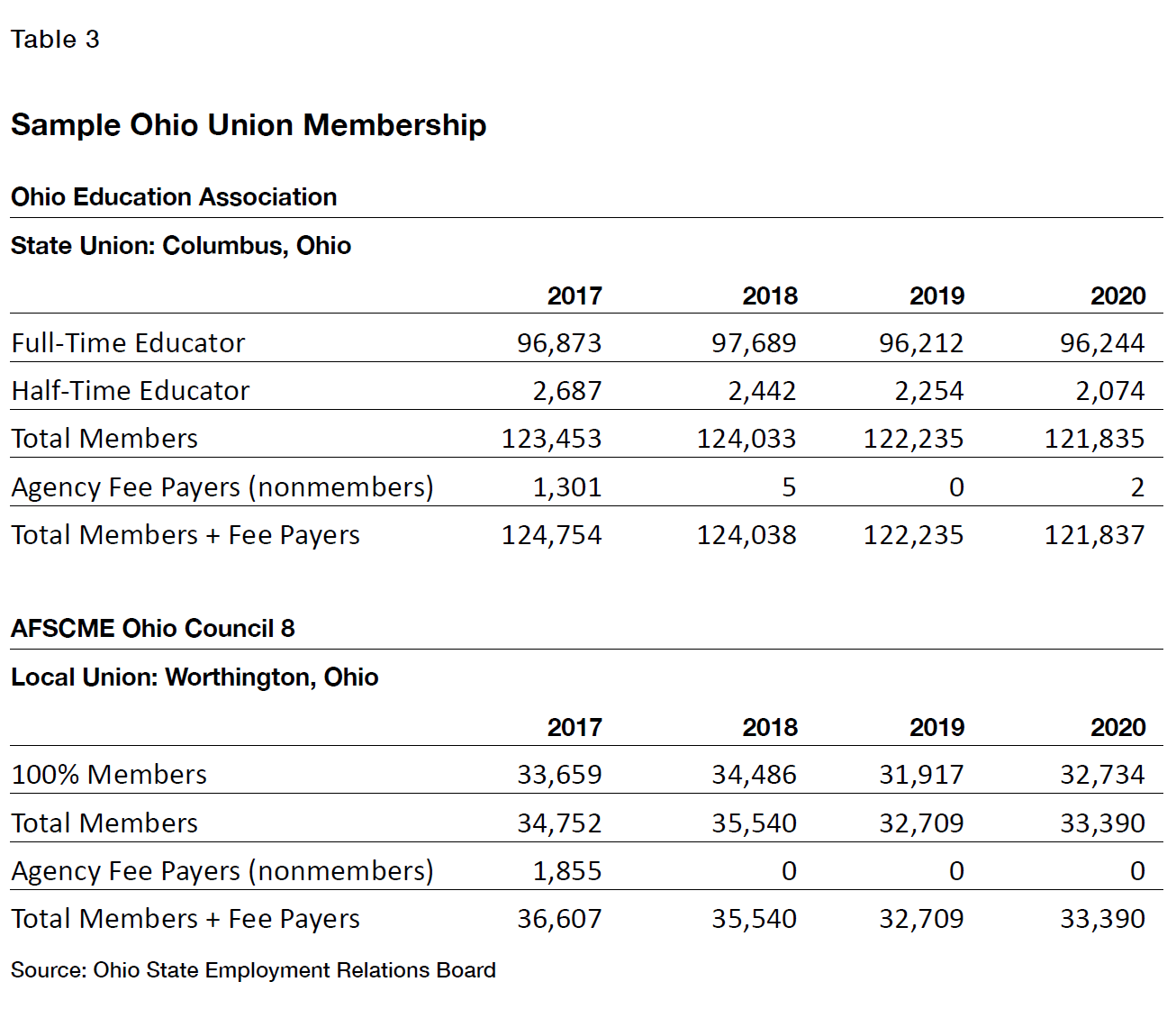

You may be able to deduct your union dues if you itemize deductions Schedule A. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. Approximately 62 of the total of NEA OEA and Local.

The 2018 Tax Reform Act changed the rules of union due deductions. Thanks to the recent changes in the tax law 2017 will be the last year you can deduct union dues on your federal income tax return. Even though Salvo and Cummings never.

Contributions to OEA-PIE and EEA-PAC. By Isabel Blank September 7 2022 News. Deductions and modifications for part-year and nonresident filers.

Part-year and nonresident filers report these deductions and. AEE collected 423185 in dues and fees from its members in tax year 2019. Elected officials of the union set union dues and typically hover around 1-2.

For several years SEIU continued to deduct 10 a month from each worker attributing the fee to an associate membership. The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized.

The idea that theyre going to give. What are typical union dues. Union dues are included in job-related expenses and are not fully deductible as they are subject to the 2.

Union dues is correctly shown on. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues. The most common structure sets dues as a percentage of gross.

You can deduct dues and initiation fees you pay for union membership. Association of Engineering Employees of Oregon 3990 Cherry Ave.

The Use Of Union Dues For Political Purposes A Discussion Of Agency Fee Objectors And Public Policy Everycrsreport Com

9th Circ Upholds Seiu Wins In Union Dues Deductions Suits Law360

Deducting Union Dues Drake17 And Prior

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

Are Union Dues Check Offs Tax Deductible

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Tax Tips Every Nurse Should Know Joyce University

Freedom Foundation Assists 100 000th Public Employee Leave Their Union Freedom Foundation

Oregon Workers Can Opt Out Stand With Workers

Paychecks And Deductions Google Sheets Tiller Community

![]()

Deducting Union Dues H R Block

Union Dues Are Now Tax Deductible Foa Law

New Mexico Asks Union Workers To Waive First Amendment Rights Local News Santafenewmexican Com

Union Dues No Longer Deductible Under New Tax Law Don T Mess With Taxes

Solved The Person Pays Social Security 6 2 Percent Of The First 90 000 Medicare Is 1 45 Percent Of All Income Use The Tax Tables For Federal Tax The State Tax Is 2 Percent