georgia property tax exemption codes

Property Tax Millage Rates. Each county has different applications and required documents.

What Are Marriage Penalties And Bonuses Tax Policy Center

Other Personal Property Exemptions.

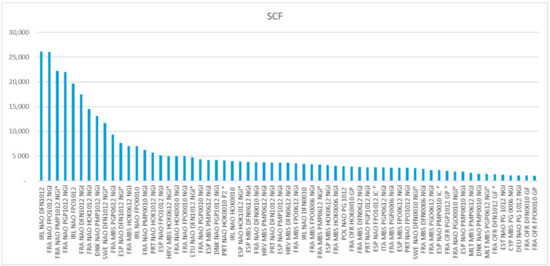

. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16. COOPF 0 COOP - Fulton County S1 Regular Homestead HF01 2000 Fulton Homestead Reg S1 Regular Homestead HF01U1 2000 HF01 UE1 S1 Regular Homestead HF01U2 2000 HF01 UE2 S1 Regular Homestead HF01U3 2000 HF01 UE3 S1 Regular. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description.

Property Tax Returns and Payment. County Property Tax Facts. It increases the exemption to 16500 for school taxes and 14000 for county levies.

Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located. Your cars must be registered in Augusta-Richmond County and you must not claim homestead on any other property.

County and City Sales Tax ID Codes. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

New signed into law May 2018. You may qualify for the S3 exemption. Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia spouse of a member of the armed forces of the US which member has been killed in any war or armed conflict in which the armed forces of the US.

The following Exemptions must be filed at the Tax Assessors Office. Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. Georgia Tax Center Help Individual Income Taxes Register New Business.

Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Apply for a Homestead Exemption. A homestead exemption can give you tax breaks on what you pay.

The exemption is 50000 off. A tax district is a geographical grouping of property within which an authority such as a county board of commissioners a school board or a city council have. Property taxes are the cornerstone of local neighborhood budgets.

You may qualify for the H2A or S4 exemption. Domestic animals in an amount not to exceed 300 in actual value. All tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value.

Widowed un-remarried spouse of police officers and firefighters killed in the line of duty may be exempt from all ad. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes. Level 1 freeport exemption.

Property exempt from taxation. You must file with the county or city where your home is located. What types of real property have been granted an exemption from Georgias property tax.

These exemptions are based on age and income. The following list sets forth the. Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter.

The general rule for all exemptions is. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. The value of the property in excess of this amount remains taxable.

It increases the exemption to 22500 for school taxes and 14000 for all county levies. Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. 2019 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-482.

CITY OF ATLANTA HOMESTEAD EXEMPTION QUALIFICATION Code. In 2018 its 81080. I am 62 to 64 years old.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The additional sum is set by the US Secretary of Veterans Affairs. Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment plants public safety services transportation and more.

H8 This has a household income limit of 16000 Gross Income. GA Code 48-5-482 2019. The Georgia Code grants several exemptions from property tax.

General. The Tax Digest Consolidated Summary herein referred to as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district. Justia US Law US Codes and Statutes Georgia Code 2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41.

Georgia counties rely on the property tax to sustain governmental services. Georgia exempts a property owner from paying property tax on. Items of personal property used in the home if not held for sale rental or other commercial use.

Qualifying disabled veterans may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. State and federal government websites often end in gov. I am 65 years old or older.

Or---x City Aged. You may qualify for the S1 exemption. Property Tax Homestead Exemptions.

For information in regard to the Exemptions listed below please call the Tax Assessors office at 770-288-7999 opt. While the state sets a minimal property tax rate each county and municipality sets its own rate. A homestead exemption can give you tax breaks on what you pay in property taxes.

The owner of the property must be a non-profit organization a copy of your IRS 501c3 award letter will be requested. Property Tax Proposed and Adopted Rules. H6 This has a household income limit of 15000 Georgia Net Income.

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

Sustainability Free Full Text Economic Impact Of Eliminating The Fuel Tax Exemption In The Eu Fishing Fleet Html

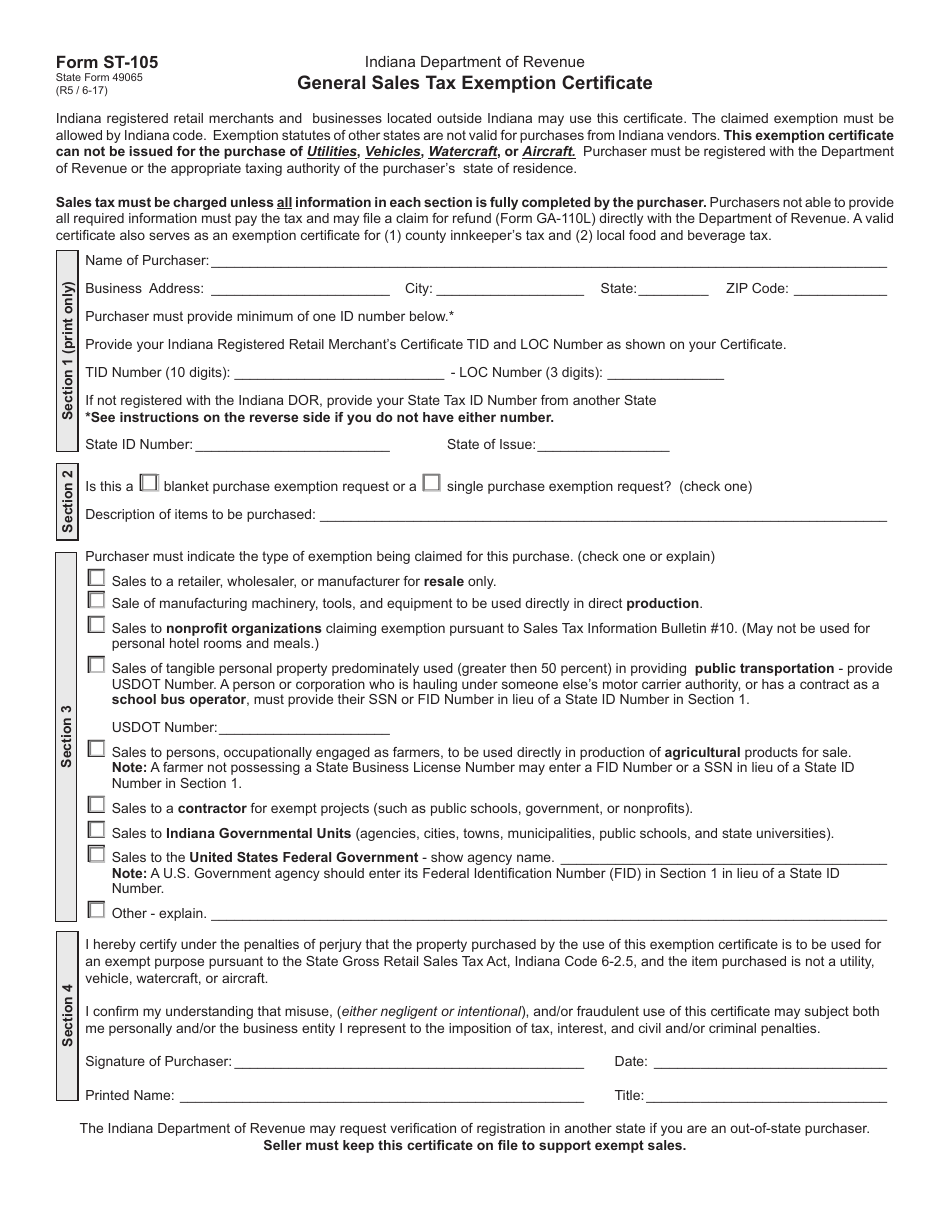

State Form 49065 St 105 Download Fillable Pdf Or Fill Online General Sales Tax Exemption Certificate Indiana Templateroller

Property Tax Comparison By State For Cross State Businesses

Requirements For Tax Exemption Tax Exempt Organizations

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Utah

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

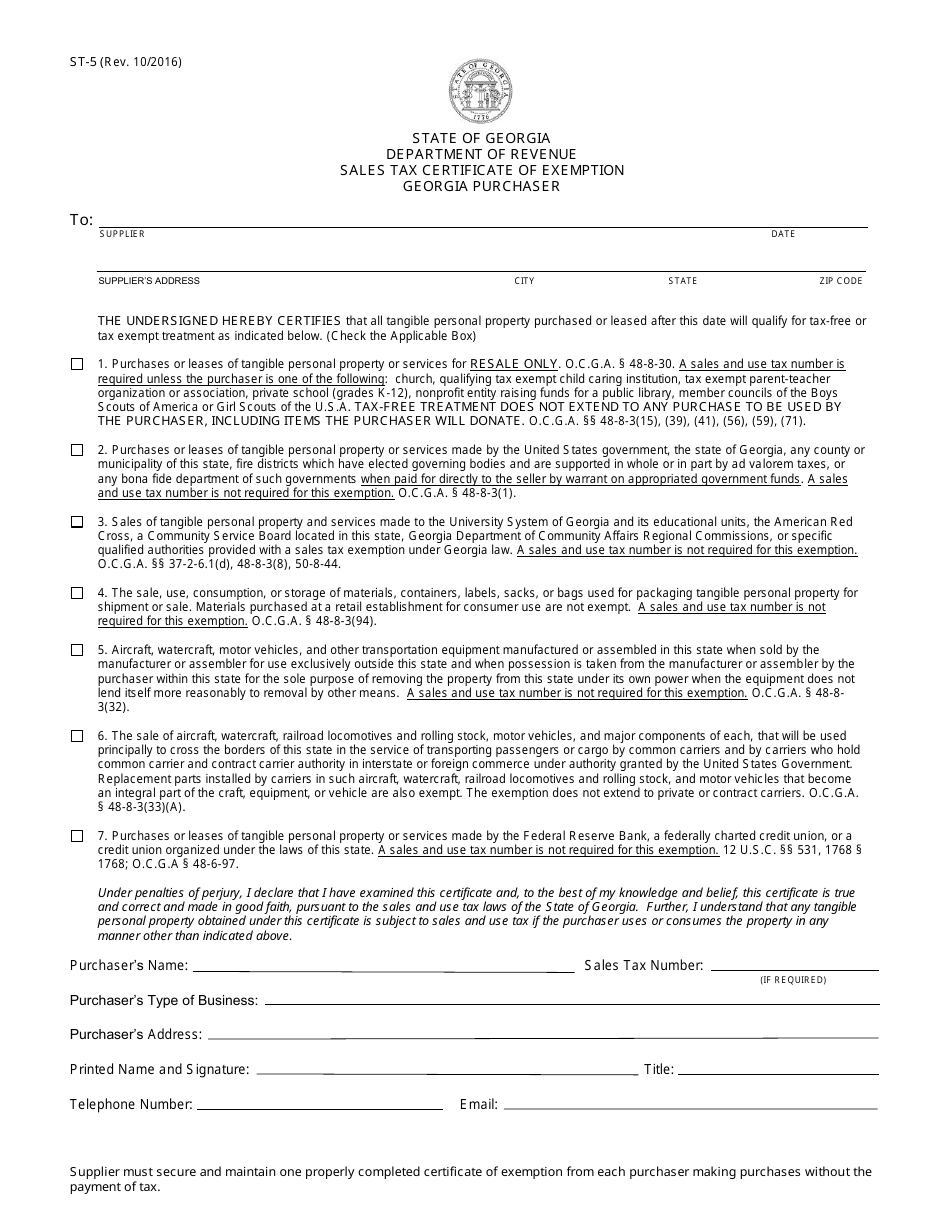

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Tax Benefits Of Owning Rural Land In 2021 Estimated Tax Payments Tax Deductions Business Tax Deductions

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

10 Ways To Be Tax Exempt Howstuffworks

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia